alabama delinquent property tax phone number

Call your county tax collection office better yet visit in person if you can and ask about the procedures in your area. Interested in buying tax properties in Alabama now.

Alabama Tax Delinquent Property Home Facebook

Failure to pay Property tax results in a Tax Lien Auction.

. Information Regarding Delinquent Property Taxes Beginning on January 1st interest and fees accrue on delinquent property taxes. Section 40-10-180 of the Code of Alabama declares the tax collecting official for each county shall have the sole authority to decide whether his or her county shall utilize the sale of a tax lien for the sale of. Assessor Revenue Commissioner and Tax Sales Mobile County Revenue Commissioner 3925 Michael Blvd Mobile AL 36609 Phone.

If not paid within 15 days an additional 2400 penalty will be charged. Search Mobile County property tax records by owner name address or parcel number and pay taxes online. For more detailed standards and requirements please refer to Administrative Rules.

Tax delinquent properties are available in Alabama year-round. The 2022 Alabama Tax Auction Season completed on June 3 2022. You may come to the Collection Department located at the Calhoun County Administration Building and pay in person.

Citation fees are 1500. Alabama delinquent property tax excelsior college transcripts January 25 2022. Calhoun County Revenue Commissioner.

Business Personal Property - 3346774757. As the Revenue Commissioner of Jackson County and on behalf of my staff we would like to welcome you to the Jackson County online property tax and vehicle tag renewal website. Step 2 Attend an auction.

Smallwood Jefferson County Tax Collector Birmingham Alabama. 3925 Michael Blvd Suite G. Before a manufactured home may be moved on the highways of Alabama a Move Permit must be obtained from the office of the Tax Collector.

If the property is not redeemed within the 3 three year redemption period Sec. You may search for transcripts of properties currently available by County CS Number Parcel Number or by the persons name in which the property was assessed when it sold to the State. Tax Delinquent Properties for Sale Search.

Welcome to the Jackson County Revenue Commissioners Website. For additional information on manufactured homes call 251 867-0299. There is a convenience fee for using a card.

To contact our office directly please call 205 325-5500 for the Birmingham Office or 205 481-4131 for the Bessemer Division. Ph 2512753376 Fx 2512753498 Example. Step 1 Find out how tax sales are conducted in your area.

Click a county below to see the states over-the-counter inventory - you can even apply for a price quote. Good news - You dont have to wait for the annual tax sales. 114 Court Street Grove Hill ALABAMA 36451.

Certified checks only after April 2nd. Property taxes are due October 1 and are delinquent after December 31 of each year. Smallwood is a lifelong resident of Jefferson County.

40-10-29 the purchaser of the Montgomery County Alabama tax lien certificate can apply for a tax deed to the property by surrendering the Montgomery County Alabama tax lien certificate to the Judge of Probate who in turn issues a tax deed Sec. 334-242-1490 General Info or 1-866-576-6531 Paperless Filing Info Taxpayer Advocacy. The steps to buying a property for delinquent taxes.

PUBLIC NOTICE TAX LIEN PUBLICATION. Learn more from the Code of Alabama Chapters 40-2 and 40-7. Official web application of the Alabama Department of Revenue.

Ask your mortgage company to pay your bill. Sign in to file returns make payments view letters and more. We are very proud of our beautiful scenic county but we feel its our people that make us such a.

1702 Noble Street Ste 104. The interest is equivalent to 1 of the tax per month plus a delinquency fee of 500 per parcel.

Tax Delinquent Land Sales In Alabama Wholesale Home Buyers

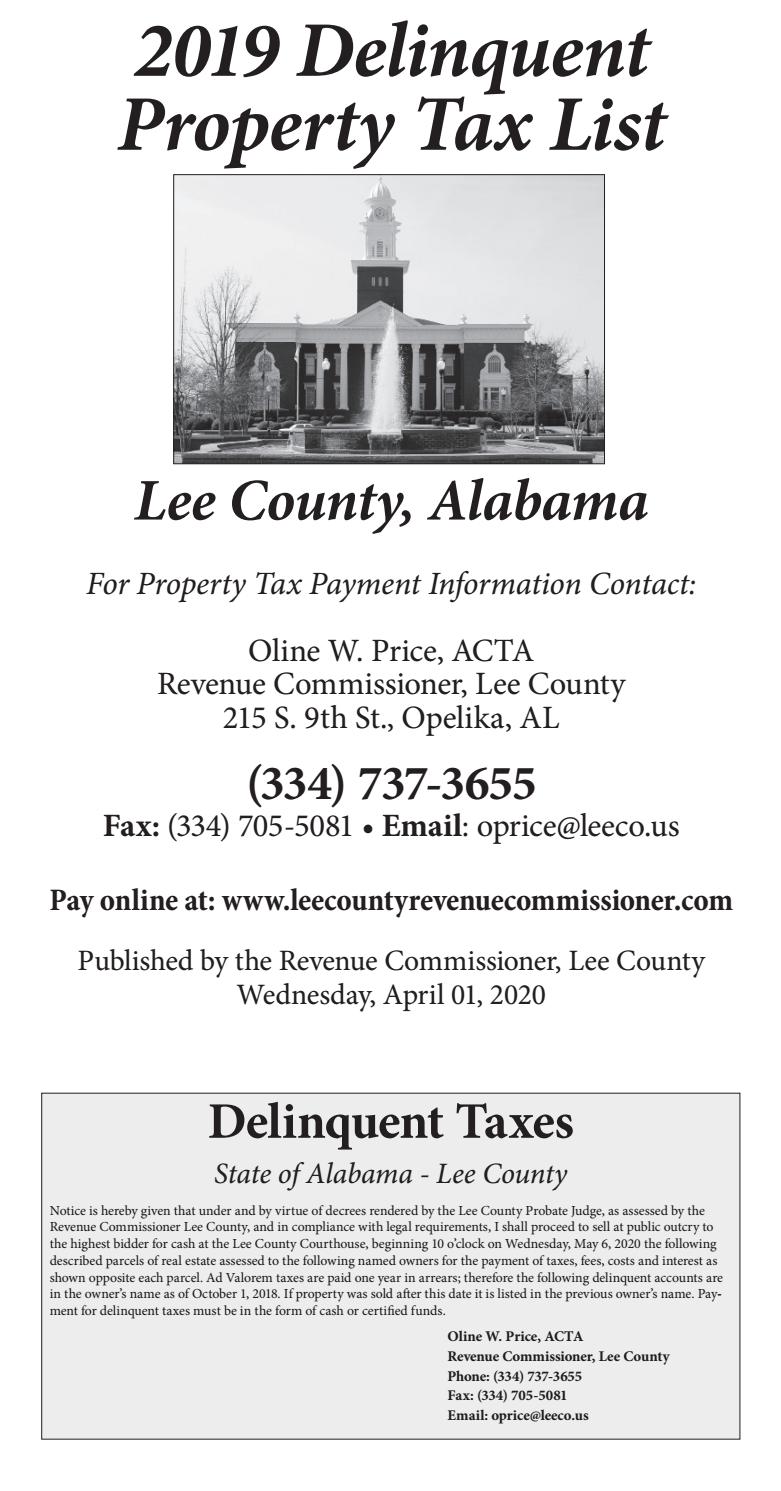

Opelika Observer Lee County 2019 Delinquent Tax List By Opelikaobserver Issuu

Greater Talladega Lincoln Chamber Of Commerce Alabama Tax Structure

Alabama Tax Delinquent Property Home Facebook

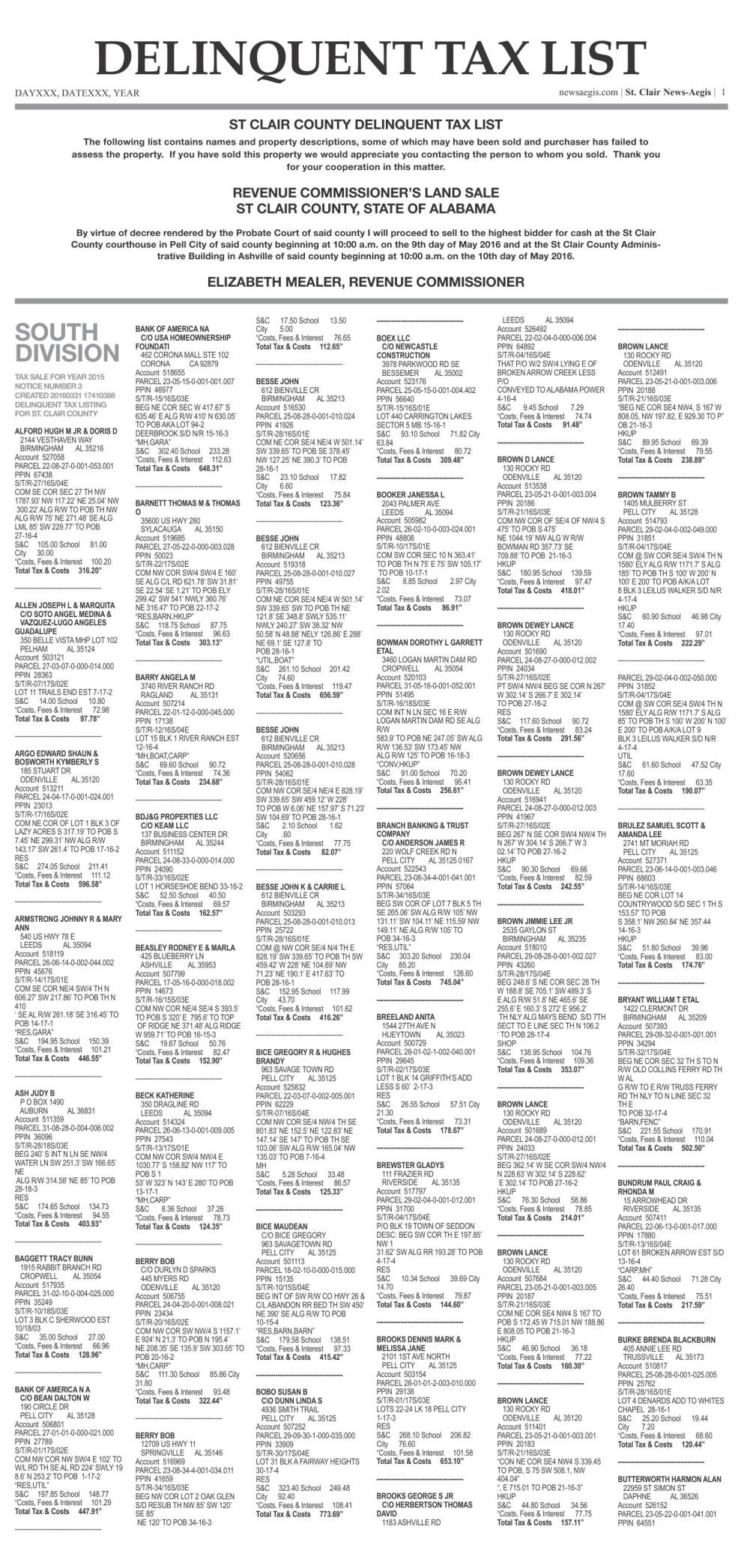

Delinquent Property Tax List St Clair County 2016 Newsaegis Com

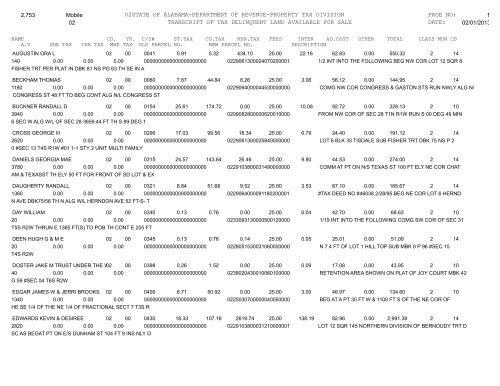

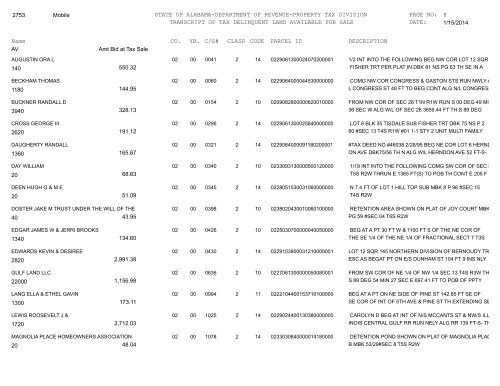

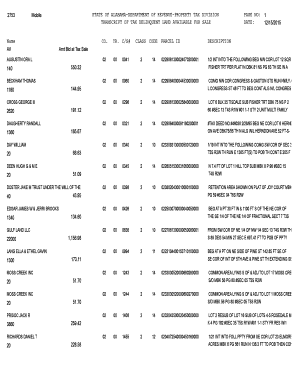

02state Of Alabama Department Of Revenue Property Tax Division

Property Tax Alabama Department Of Revenue

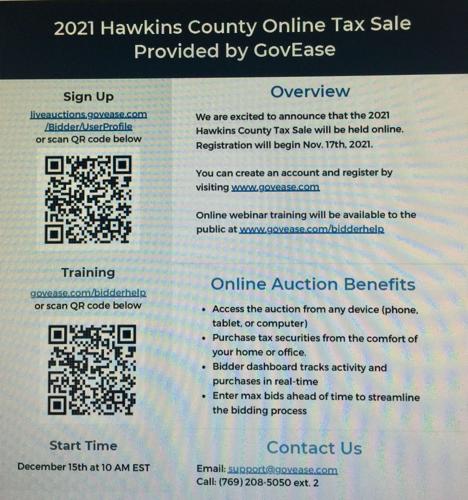

Hawkins County Online Delinquent Tax Property Auctions Begin In December Rogersville Therogersvillereview Com

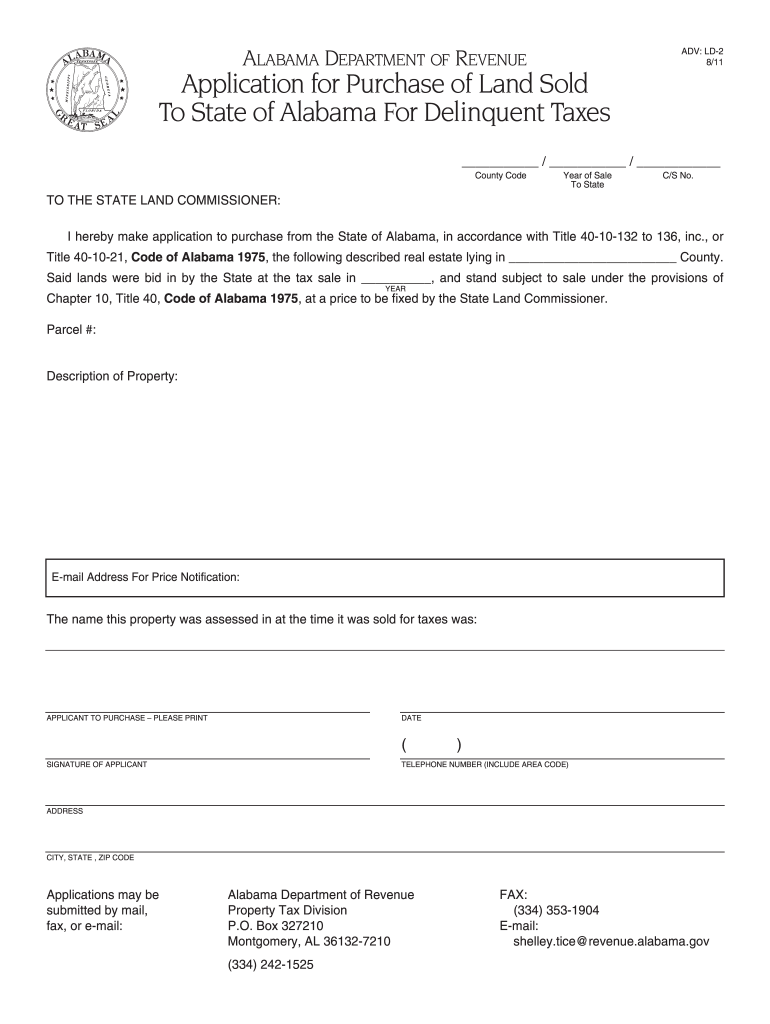

Al Adv Ld 2 2011 2022 Fill Out Tax Template Online Us Legal Forms

Alabama Tax Delinquent Property Home Facebook

02state Of Alabama Department Of Revenue Property Tax Division

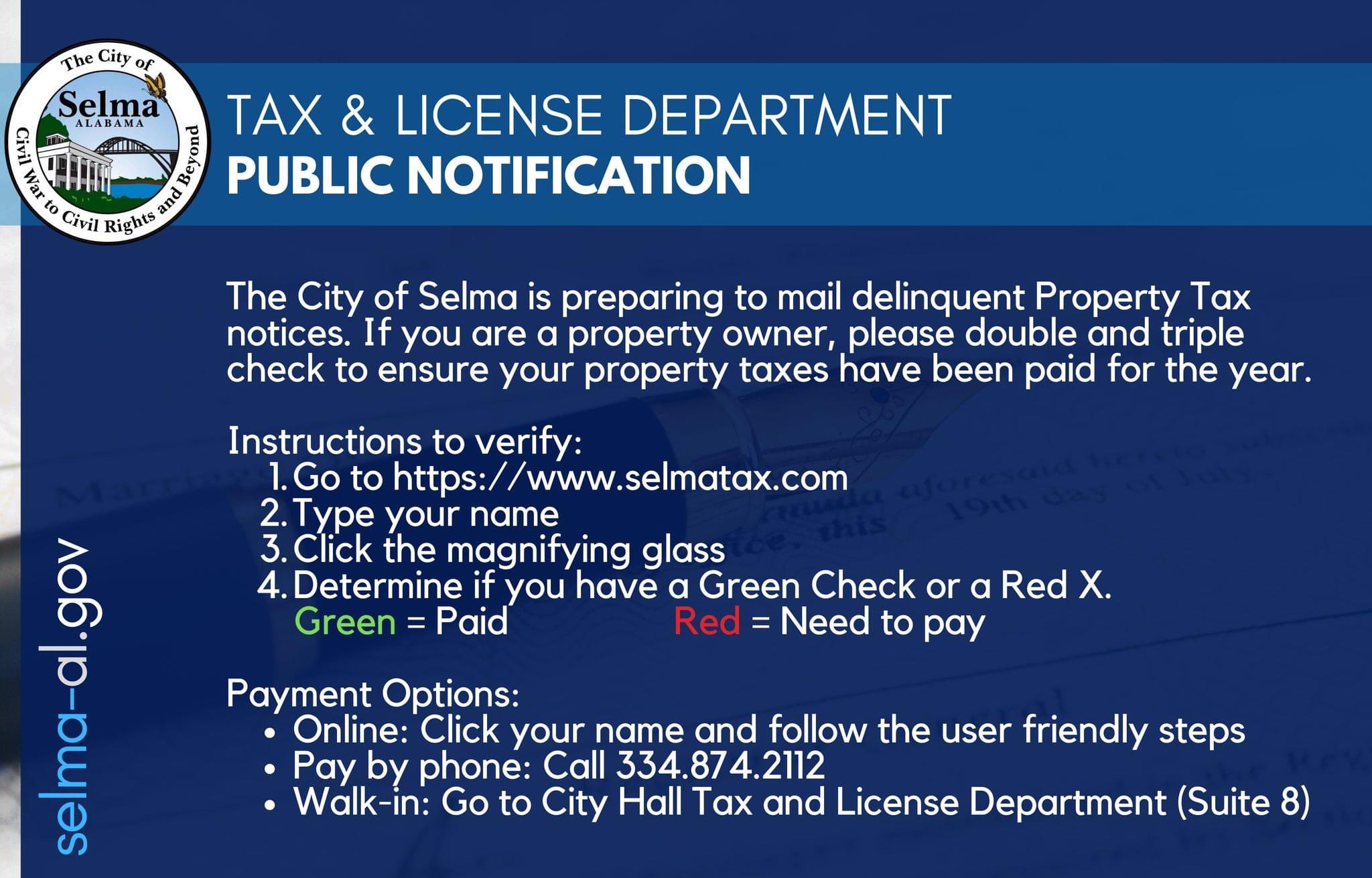

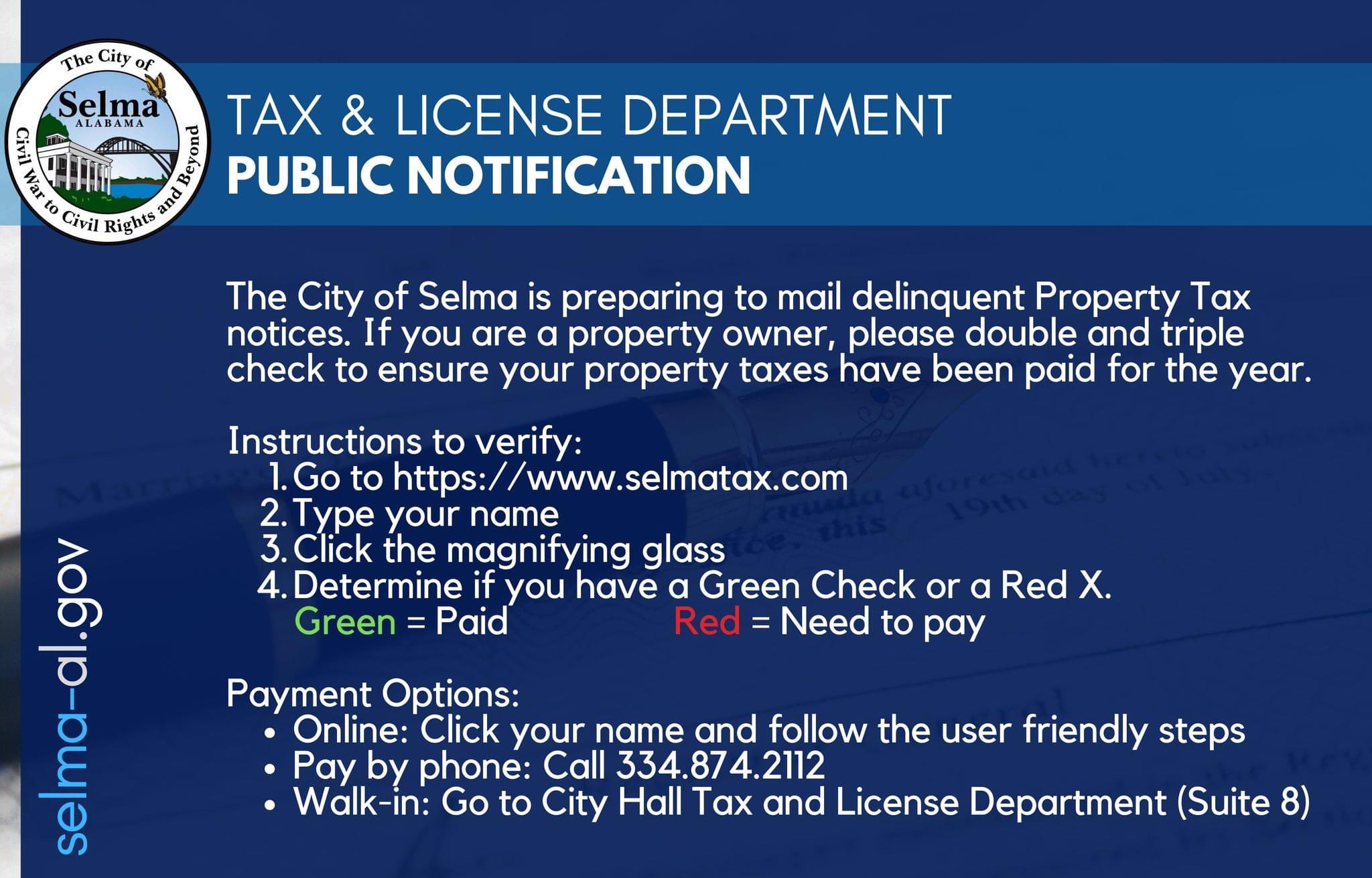

Historic Selma Alabama On Twitter Public Notice Delinquent Property Tax Notices Are Being Mailed Follow These Simple Instructions To Ensure That Your Taxes Are Paid And Current Https T Co V3et5zfypl Twitter

Fillable Online Revenue Alabama Transcript Of Tax Delinquent Land Available For Sale Revenue Alabama Fax Email Print Pdffiller

Jefferson County 2022 Property Valuations Protest Deadline Is July 30 2022 Burr Forman

Alabama Tax Delinquent Property Home Facebook

How Is Sale Of Tax Liens For Collection Delinquent Property Tax Handled

Shelby County Alabama Property Tax Commissioner Tax Lien Information Site